When Meta Platforms confirmed it had acquired Manus for more than $2 billion, the headline felt familiar. Another Big Tech deal. Another artificial intelligence arms race. Another eye watering valuation.

Look closer and the story is less about size and more about direction. Meta is not buying a model to talk better. It is buying a system designed to act. The Manus acquisition marks a clear pivot away from conversational intelligence toward execution driven AI, and it reveals how seriously Meta believes the next phase of AI competition will be defined.

The acquisition came together quickly, reportedly in under two weeks. Manus was already in the middle of fundraising talks at a roughly $2 billion valuation when Meta stepped in and closed the deal outright. Estimates place the final price between $2 and $3 billion.

Meta has said Manus will continue operating its app and subscription business without disruption. The product remains live. Paying customers remain paying customers. Behind the scenes, however, the integration plan is clear. Manus technology and staff will feed directly into Meta’s consumer and enterprise AI efforts, including Meta AI.

The deal also cleanly cuts Manus’s remaining ties to China. The company has shifted its workforce to Singapore and confirmed there is no continuing Chinese ownership. That point was not a footnote. It was central to the announcement.

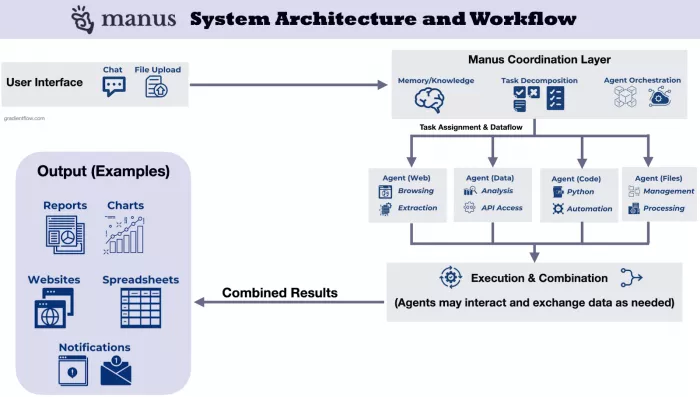

Manus is not another chatbot layered on top of a language model. It is a task execution agent. The distinction matters.

Where most consumer AI products focus on answering questions, Manus focuses on completing objectives. Its system breaks down goals, navigates browsers, calls APIs, writes and debugs code, analyzes data, generates reports, and verifies outcomes without constant human prompting.

In practical terms, users do not ask Manus for advice. They assign it work.

That capability grew out of an earlier product called Monica, a browser extension developed under the Butterfly Effect umbrella that attracted more than 10 million users globally. Manus spun out as a standalone company in early 2025, repositioned around autonomous agents rather than assistance.

The name itself is deliberate. Manus is Latin for hand. The product was designed to do, not to speak.

Meta already has models. Its open source Llama family powers research, chatbots, and experimentation across the industry. What Llama does not solve is monetization at scale.

Autonomous agents change that equation. An agent that completes tasks creates measurable value. It saves time. It replaces labor. It fits neatly into enterprise workflows. Manus already had what Meta lacked: millions of paying users and a clear revenue engine.

Manus reportedly crossed $100 million in annual recurring revenue within eight months of launching paid plans. By December 2025, that figure had climbed to a $125 million run rate with more than 20 percent month over month growth following its 1.5 release.

This is not speculative usage. It is production usage.

Manus was founded by Xiao Hong, often called Red Xiao, a Chinese entrepreneur born in 1992 with a track record of building developer tools that scale. He previously founded Nightingale Technology and created popular WeChat utilities that attracted Tencent backing.

The technical architecture is led by co founder Ji Yichao, a developer known for earlier projects like Mammoth Browser and the Magi search engine. Together, they built a team that deliberately moved operations to Singapore to reduce geopolitical risk as the company grew.

Under Meta, Xiao Hong will report into senior leadership, a signal that this is not an acquihire buried in a lab. It is a core platform bet.

This deal stands out because it runs against the current of global tech fragmentation. US firms have been cautious about acquiring AI companies with Chinese origins due to export controls and regulatory scrutiny.

Meta leaned into that risk and neutralized it. Manus is now Singapore based, US owned, and globally deployed. For Meta, the upside outweighed the complexity.

It also sends a message to competitors. If agentic AI is the next battleground, Meta intends to own territory early.

The Manus acquisition does not stand alone. It follows Meta’s massive investment in Scale AI earlier in 2025 and a string of talent moves pulling researchers from OpenAI and Google.

Together, these moves outline a coherent strategy. Meta is building an AI stack that spans models, data, execution, and distribution. WhatsApp, Instagram, Facebook, and enterprise tools become delivery rails for agents that actually perform work.

Chat is table stakes. Execution is the moat.

| Metric | Reported Figure | Context |

| Acquisition Price | $2 to $3 billion | Closed December 2025 |

| Annual Revenue Run Rate | $125 million | As of December 2025 |

| Time to $100M ARR | 8 months | Post paid launch |

| Monthly Growth | 20 percent plus | After Manus 1.5 |

| Tokens Processed | 147 trillion | Since launch |

| Virtual Computers | 80 million plus | Cumulative usage |

| Subscription Pricing | $39 to $199 per month | Focused on enterprise |

These figures explain why Meta moved quickly. Manus was not a promise. It was already operating at scale.

Reaction across the tech industry has been split. Supporters see the deal as validation that agents, not chatbots, represent the next wave of AI value. Skeptics question whether early benchmark performance and rapid growth can sustain under broader deployment.

Those questions are fair. Autonomous systems introduce complexity, risk, and new failure modes. They also introduce leverage. A system that completes tasks compounds value faster than one that merely responds.

Meta is betting that execution wins.

Meta did not buy Manus to catch up. It bought Manus to change the game it is playing.

The acquisition marks a shift away from intelligence as spectacle and toward intelligence as infrastructure. It suggests that the next AI winners will not be those who generate the most impressive demos, but those who quietly replace workflows at scale.

In that sense, the Manus deal is less about competition with OpenAI and more about redefining what success in AI actually looks like.

If chat was the first chapter of consumer AI, execution is the second. Meta just paid $2 billion to make sure it gets written on its terms.

Discussion